Checking Account Security 101: Safeguarding Your Finances

Published: December 22, 2023 2:48 pm Last updated: January 22nd, 2024 2:58 pmIn a digital world, checking account security should be a top priority. Since more and more people prefer online banking, knowing the basics of keeping your finances safe is vital. In this blog, we’ll cover the essentials of checking account security to ensure you understand how to protect your money.

1. Choosing a Strong Password

Choosing a strong password is critical in ensuring your checking account’s security. Avoid easy passwords such as “password” or “1234”. Instead, select lengthy passwords with uppercase and lowercase letters, numbers, and symbols. Ideally, your password should be at least 12 characters long and unique to your accounts. Also, be sure not to use the same password for your different accounts.

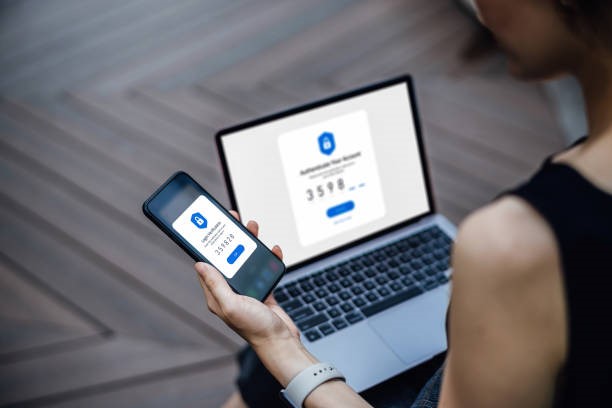

2. Enabling Two-Factor Authentication

Set an extra layer of protection to your account. With 2FA, the bank sends a unique code or token to your registered mobile phone number or email to access your account. This method is a highly effective way to prevent unauthorized access and financial loss.

3. Avoiding Suspicious Emails and Phone Calls

Scammers may use emails and phone calls to obtain your personal information and access your account. They may use a fake email or phone number to pose as a bank representative and ask for sensitive information. Never share your personal information with an unverified source to avoid these scams.

4. Keeping Your Software Up-to-Date

Regularly updating your device’s software is essential as it fixes vulnerabilities and bugs that cybercriminals could exploit. Ensure you have the latest anti-virus, anti-malware, and firewall software installed on your computer to prevent unauthorized access. Maintaining up-to-date software helps your devices function correctly and protects your online security.

5. Using Strong Network Security

Try to use a VPN connection to secure your device when using public Wi-Fi. This security measure ensures that hackers cannot access your data when using the internet outside your private link, making it more difficult for unauthorized individuals to access your account details.

In conclusion, securing your checking account involves taking a few basic steps to protect your identity and financial data. By following these essential security tips, you can help ensure your checking account remains safe from cyber-attacks and protect your finances in a digital world. To learn more about how to handle your finances, contact us today at Energy One Federal Credit Union.

Tags: #accountsecurity, #checkingaccountsecurity, #securingfinances